Geothermal, or ground source heat pumps, are the most energy-efficient way to heat and cool your home and greatly reduce your energy bills and reliance on fossil fuels.

With $1000s in rebates available from the federal government, states, and utilities, it's never been easier—or more affordable—to switch to the most efficient and eco-friendly technology available.

Below you'll find detailed information on geothermal incentives available across the Northeast.

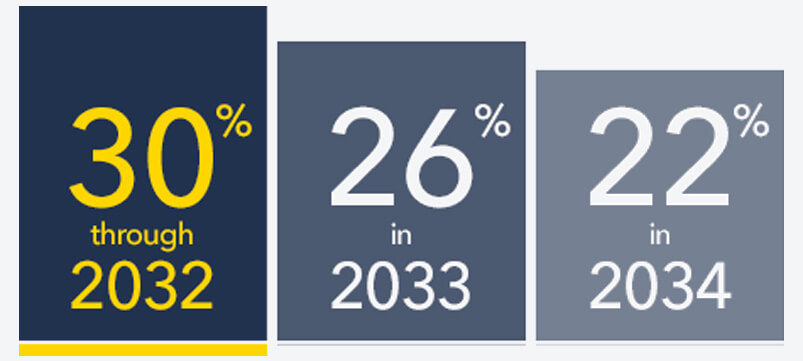

In 2022, the federal tax incentives known as the Investment Tax Credit (ITC) rose to 30% of a Dandelion geothermal system. However, the percentage covered by the ITC will decrease to 26% in 2033, and 22% in 2034.

Learn More

New York State offers a 25% tax credit on geothermal installation expenses, up to $5,000.

Additionally, homeowners are eligible for New York State's Clean Heat Program, which is administered by the homeowner’s utility. Let’s go over some important details to explain how these incentives are allocated.

Each utility has a unique incentive.

The incentive amounts are based on the installed heat pump’s total heating capacity BTUH.

PSEG Long Island rebate is based on the COP and EER of the unit. Long Island homeowners who install a typical 4 ton system (48,000 BTU) in a 2500 sq ft home get an $8,383 rebate for a new Dandelion Geothermal system. Rebates are capped at 70% of project cost.

The rebate program requires a pre-inspection and post-inspection step at the customer's home. Dandelion has built this into the installation timeline to ensure all rebate requirements are met.

Below is a list of the PSEG rebate based on system size:

Both Eversource and United Illuminating offer geothermal heat pump incentives via the EnergizeCT program (The following municipal utilities are not part of the EnergizeCT program; Groton, Bozrah, Norwalk, Wallingford, and Norwich). Geothermal systems are also exempt from Connecticut sales tax.

The Connecticut incentives are limited to $15,000 per household, or 10 tons worth of geothermal heat pumps. See the table below for an example of what an average sized home that needs a 5 ton geothermal heat pump system would qualify for in Connecticut.

With MassSave incentives, MA homeowners qualify for a $15,000 rebate for a new Dandelion Geothermal system. Geothermal systems are also exempt from state sales tax.

There are additional rebates available through the Alternative Energy Portfolio Standard for reducing greenhouse gas emissions that range from $400-$1,200/year for up to 10 years.

Green Mountain Power offers an incentive of $1,800 per ton that is based on the system’s heating output, and Efficiency Vermont is offering an additional $300, for a combined $2,100 per ton.

Rockland Electric (RECO) Homeowners are eligible for $0.20/BTUH rebate. On average, a 2,500 square foot home that installs a 5 Ton 47,900 BTUH Heat Pump will receive $9,580 Rebate. Homeowners can also claim a $500 rebate through the state’s COOLAdvantage program.